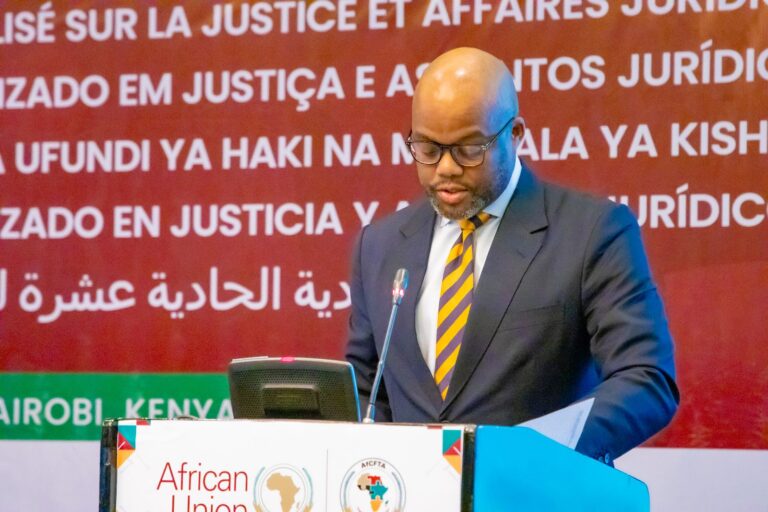

Nairobi, Kenya, 5 September 2024 – H.E. Wamkele Mene, Secretary-General of the African Continental Free Trade Area (AfCFTA) Secretariat, delivered the keynote address at the Eleventh Africa Fintech Summit, held in Nairobi, Kenya. The summit, themed “Fintech in Every Industry,” brought together government officials, regulators, investors, entrepreneurs, fintech innovators, and other key stakeholders from across Africa and beyond to discuss the role of financial technology in driving the continent’s economic development.

In his address, H.E. Mene emphasised the growing importance of fintech in shaping Africa’s future, particularly in advancing inclusive socio-economic development for small and medium enterprises (SMEs), women, and youth entrepreneurs. He noted that Africa’s fintech sector is one of the fastest growing in the world, citing the inclusion of six African companies in CNBC’s prestigious list of the top 250 fintech firms globally, four of which hail from Nigeria and two from South Africa.

H.E. Mene highlighted the continent’s remarkable progress in fintech, noting projections that Africa will experience a compound annual growth rate (CAGR) of 32%, with the fintech market expected to reach $65 billion by 2030. He remarked that this growth is outpacing other regions, including Latin America, Asia-Pacific, and Europe, further solidifying Africa’s position as a leader in financial technology innovation.

“Africa’s fintech companies are transforming financial services, driving financial inclusion, and addressing the unique challenges faced by African consumers and businesses. They are providing innovative digital lending solutions to small businesses and individuals, helping to close the credit gap across the continent,” said H.E. Mene.

However, the Secretary-General also acknowledged the challenges facing the fintech industry, including regulatory barriers, cybersecurity risks, and infrastructure gaps. In response, he underscored the importance of the AfCFTA’s Protocol on Digital Trade, which includes dedicated provisions for financial technology and cross-border digital payments, with negotiations on its Annexes nearing completion.

The AfCFTA Secretariat’s commitment to supporting Africa’s digital transformation was further highlighted by the Secretary-General’s reference to the Pan-African Payment and Settlement System (PAPSS). PAPSS, a collaboration between the AfCFTA Secretariat, Afreximbank, and the African Union, is enabling instant cross-border transactions, bringing 14 central banks, seven national switches, and four private switches into the system.

“Fintech will significantly complement the work we are doing at the AfCFTA, particularly in enabling inclusive, secure, and affordable cross-border digital payments, which are critical to the success of the AfCFTA and the creation of a One African Market,” H.E. Mene stated.

In concluding his remarks, the Secretary-General issued a call to action to all stakeholders, urging governments, policymakers, regulators, and industry players to provide the necessary resources and support to expand the African fintech industry beyond the dominant markets of South Africa, Nigeria, Kenya, and Egypt. He emphasised that the continent’s youthful, tech-savvy population, coupled with increasing internet and mobile penetration, presents a unique opportunity for Africa to lead in digital financial innovation.

“We must ensure that Africa’s digital transformation benefits all countries and regions. Together, we can build an inclusive and prosperous digital future for our continent,” H.E. Mene concluded.

The Africa Fintech Summit provided a platform for high-level discussions on how fintech can accelerate economic growth, foster financial inclusion, and support the realisation of the AfCFTA’s vision of creating a single, integrated African market.