The Intra African Trade Fair (IATF) 2023 not only provided a platform for showcasing the potential of African commerce but has also shed light on a crucial element that underpins economic growth and inclusivity in the continent – Digital Financial Inclusion (DFI). The AfCFTA Secretariat has placed a spotlight on the importance of DFI throughout its sessions, recognizing its pivotal role in shaping the future of trade and investment in Africa.

Day 3

Date: 11th November:

Session topic: Accelerating Investment Inflow with the AfCFTA Protocol on Investment

The third day of IATF 2023 focused on accelerating investment inflow, and once again, the issue of payments took center stage. Participants highlighted that women could access finance more readily with evidence of digital payments. Digital payments systems are instrumental in creating transparency and trust, essential for attracting investments and partnerships. The distinguished panelists and participants of the event agreed that there is a need to enhance payment systems throughout the continent whereby policymakers and regulators, are required to adopt favourable policies that align with the objectives of the AfCFTA.

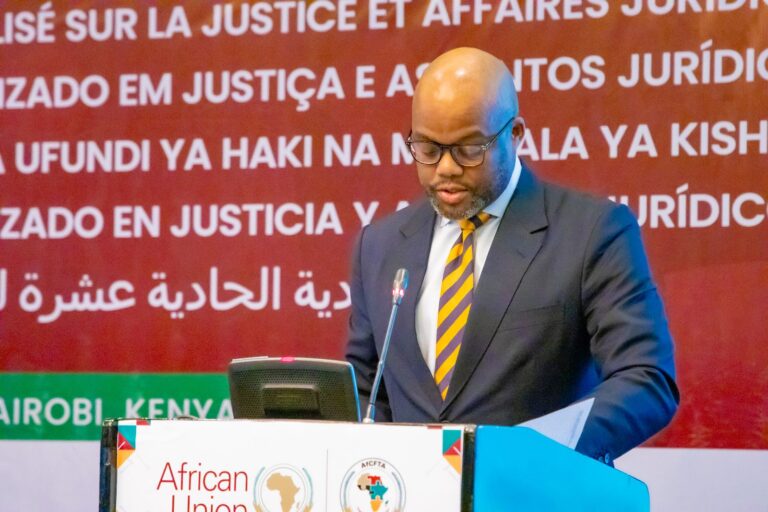

Once again, this brings to the forefront the opportunities of Africa’s payment landscape to equip women with the insights they need to motivate investments, partnerships, and progress toward inclusivity. The Secretary-General of the AfCFTA Secretariat, H.E. Wamkele Mene, emphasized the need for favorable payment policies to align with the AfCFTA’s objectives. His words resonated deeply:

“The intention is to make sure that the investment flows intra Africa and into the continent have a particular public policy objective, and that public policy objective: industrial development of our continent (investing in sectors of our continent that will make substantive differences for the advancement of our continent. We must focus on how to use the protocol to direct public sector gains and investment infrastructure for each other. As we say that the African continent is open for business and investment, we must use this Protocol to encourage to invest in digital infrastructure that will enable inclusivity, that will enable benefits for all. So we have a very unique opportunity to use this protocol in a way that we direct our continent into a new growth path in the area of digital economy and digitization.”

H.E. Wamkele Mene

These words underscored the transformative potential of DFI in advancing Africa’s industrial development and fostering digital inclusion.

Day 4:

Date: 12th November

Session topic :How Value Addition Can Grow Basic into Luxury.

One of the highlights of IATF 2023 was the all-women panel discussion titled “How Value Addition Can Grow Basic into Luxury.” During this session, which was moderated by Ms Cynthia Gnassingbe, Head of Private Sector Engagement at the AfCFTA Secretariat, it became abundantly clear during the discussions that payments are a major stumbling block hindering women’s participation in trade. The women CEOs shared practical examples of difficulties they’ve faced accessing the needed raw materials on the continent due to payment challenges, resulting in missed opportunities. DFI emerged as a solution, accessibility, and efficiency. The cashless movement also offered security benefits for women traders who were at less risk of attacks due to not carrying cash. By going cashless, women traders can more easily source raw materials from different countries and engage in cross-border trade. The session served as an inspiring testament to the power of DFI in leveling the playing field for women entrepreneurs, particularly with regards to accessing raw materials from cross border traders.

DAY 6:

Date: 14th November:

Session topic: Joint Session with AfCFTA and the Private Sector

A joint session with AfCFTA and the Private Sector delved into critical issues facing the African business environment. During the discussion on currency dynamics and banking systems, it became evident that digital payments play a pivotal role in shaping these dynamics. Banking systems must enable digital financial inclusion, particularly for women engaged in cross-border trade. The importance of DFI was reaffirmed as a driver of currency dynamics, offering a pathway to economic empowerment for women.

Panel 1 Theme: Intra-Africa Trading – Currency Dynamics and Banking Systems

The panel discussion on intra-Africa trading, currency dynamics, and banking systems at the AfCFTA Pavilion at IATF 2023 brought to the forefront the critical importance of Digital Financial Inclusion (DFI) in shaping the continent’s economic landscape. With Dr. Lucy Surhyel Newman, CEO of the Africa Public Sector Symposium (APSS), moderating the session and Professor Kingsley Moghalu, the former Deputy Governor of the Central Bank of Nigeria, as the lead panellist, the discussion was nothing short of enlightening.

One of the central themes of this session was the pivotal role that digital payments play in currency dynamics. Africa’s diverse currencies and exchange rates have often posed challenges for cross-border trade. However, DFI can be a game-changer in this regard. Digital payment systems, including mobile money and online banking, can streamline currency conversions and facilitate seamless cross-border transactions. This not only simplifies trade but also opens up new opportunities for businesses, particularly small and medium-sized enterprises (SMEs), to expand their market reach.

Panel 2: Cross Border Trade and Logistics

The second panel session at IATF 2023, focusing on cross-border trade and logistics, delved deeper into the critical role of Digital Financial Inclusion (DFI) in fostering seamless trade relations and enabling the movement of people for business purposes. This session, moderated by Dr. Lucy Surhyel Newman, CEO of the Africa Public Sector Symposium (APSS), featured Mr. John Bosco Kalisa, CEO of the East African Business Council (EABC), as the lead panellist.

The discussion underscored the fact that payments are integral to cross-border trade. Whether it’s paying for goods and services, customs fees, or transportation costs, a reliable and efficient payment system is fundamental for businesses engaging in international trade. However, without DFI, there’s a risk of leaving critical stakeholders behind, particularly women involved in cross-border commerce.

One of the key takeaways from this panel was the recognition that DFI can serve as a powerful equalizer. It enables women entrepreneurs to participate fully in cross-border trade by providing them with access to secure and efficient digital payment methods. With the right financial tools at their disposal, women traders can navigate the complexities of international trade more effectively, expand their businesses, and contribute to their countries’ economic growth.

Day 7

Date: 15th November

Topic: Technology in Support of Trade Facilitation and Customs

The session on technology in support of trade facilitation and customs at IATF 2023 showcased the pivotal role that Digital Financial Inclusion (DFI) plays in advancing trade efficiency and cross-border collaboration. This session, a critical part of the discussions during the event, explored how digitalization and technological innovations are transforming trade facilitation and customs procedures,

Panellists emphasized the importance of governments and regulatory bodies in creating an environment conducive to DFI-driven trade facilitation. Policymakers should prioritize the development of digital payment infrastructure, encourage fintech innovation, and establish clear and harmonized regulatory frameworks for cross-border transactions. By doing so, governments can pave the way for DFI to thrive and positively impact trade efficiency.

Another crucial aspect discussed during the session was the need to enhance financial literacy, particularly among small businesses and women entrepreneurs. Providing education and training on digital financial services is essential to ensure that all stakeholders can fully leverage these tools for trade. Financial education programs can empower individuals to make informed decisions and manage their finances effectively.

The AfCFTA Secretariat’s commitment to promoting Digital Financial Inclusion at IATF 2023 is a testament to its understanding of the pivotal role DFI plays in driving trade, investment, and economic growth in Africa. DFI is not just a solution; it is a catalyst for empowering women in trade, attracting investments, and fostering inclusivity. As Africa embraces the digital age, DFI emerges as a cornerstone for a more prosperous and equitable continent, where economic opportunities are accessible to all. H.E. Mene’s speech serves as a clarion call for African nations to seize the unique opportunity presented by DFI to propel the continent into a new era of digital economy and inclusivity.